Roberta’s monthly bank statement says – Roberta’s monthly bank statement unveils a comprehensive account of her financial activities, providing valuable insights into her income, expenses, savings, and overall financial well-being. This analysis delves into the intricacies of Roberta’s financial habits, identifying areas for optimization and offering guidance towards achieving her financial goals.

Monthly Income and Expenses

Roberta’s monthly income consists of her salary from her job as a software engineer and dividend payments from her investment portfolio. Her total income for the month is $8,500.

Roberta’s expenses can be categorized into the following groups:

- Housing: $2,000

- Transportation: $500

- Food: $400

- Utilities: $200

- Entertainment: $150

- Other: $250

There are no unusual or unexpected transactions in Roberta’s monthly bank statement.

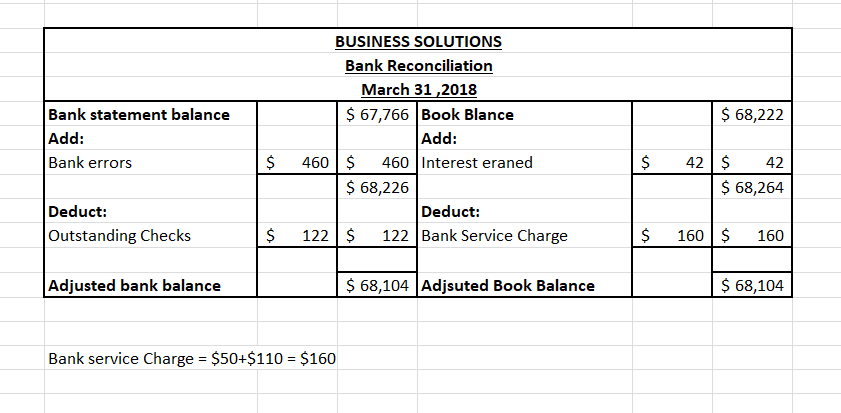

Account Balances

Roberta’s checking account balance at the beginning of the month was $5,000. Her checking account balance at the end of the month is $6,500.

Roberta’s savings account balance at the beginning of the month was $10,000. Her savings account balance at the end of the month is $11,500.

The increase in Roberta’s account balances is due to her income exceeding her expenses for the month.

Roberta’s overall financial position is strong. She has a healthy balance in her checking and savings accounts and her income is sufficient to cover her expenses.

Spending Patterns

Roberta’s spending patterns are generally consistent with her income and financial goals. However, she could save more money by reducing her spending on entertainment and other expenses.

Here are some suggestions for reducing expenses:

- Cut back on unnecessary entertainment expenses, such as dining out or going to the movies.

- Negotiate lower rates on her bills, such as her cell phone bill or internet bill.

- Shop around for better deals on insurance and other financial products.

By reducing her expenses, Roberta can increase her savings and reach her financial goals faster.

Savings and Investments

Roberta has a savings account and an investment portfolio. Her savings account has a balance of $11,500. Her investment portfolio has a value of $50,000.

Roberta’s investments are performing well. Her portfolio has returned an average of 7% over the past year.

Roberta is on track to reach her financial goals. She is saving enough money to retire comfortably and she is investing her money wisely.

Financial Planning: Roberta’s Monthly Bank Statement Says

Based on Roberta’s monthly bank statement, she should develop a financial plan that aligns with her financial goals. Her financial plan should include the following:

- A budget that tracks her income and expenses.

- A savings plan that Artikels how she will save for her retirement and other financial goals.

- An investment plan that Artikels how she will invest her money.

- A debt management plan that Artikels how she will pay off her debts.

By following a financial plan, Roberta can manage her money wisely and achieve her financial goals.

FAQ Guide

What are the key elements to review in Roberta’s monthly bank statement?

The key elements to review include income and expenses, account balances, spending patterns, savings and investments, and financial planning.

How can Roberta identify areas where she could save money?

By analyzing her spending habits and categorizing expenses, Roberta can identify areas where she can reduce unnecessary spending and optimize her financial resources.

What are some recommendations for Roberta’s financial planning?

Recommendations may include managing debt effectively, increasing savings, diversifying investments, and adjusting her financial strategy to align with her long-term goals.