Mcknight company is considering two different – McKnight Company stands at a crossroads, contemplating two distinct options that promise to reshape its trajectory. This in-depth analysis delves into the intricate details of each option, meticulously examining their market potential, financial viability, operational requirements, and strategic implications.

As we embark on this journey, we will uncover the nuances of each option, illuminating its strengths and potential pitfalls. Through a rigorous evaluation of market dynamics, financial projections, and operational considerations, we will provide a comprehensive assessment to guide McKnight Company towards an informed decision.

Market Analysis

The target market for Option 1 consists of small businesses and entrepreneurs seeking cost-effective and flexible business solutions. Option 2 targets large corporations and government agencies with complex IT infrastructure requirements.

Option 1 has a potential market size of approximately 25 million businesses in the United States, with a growth prospect of 5% annually. Option 2 targets a smaller market of approximately 500,000 large corporations and government agencies, but with a higher growth prospect of 10% annually.

The competitive landscape for both options is highly fragmented, with numerous established players and emerging startups. Key competitors for Option 1 include Salesforce, HubSpot, and Zoho. For Option 2, the primary competitors are IBM, Oracle, and Microsoft.

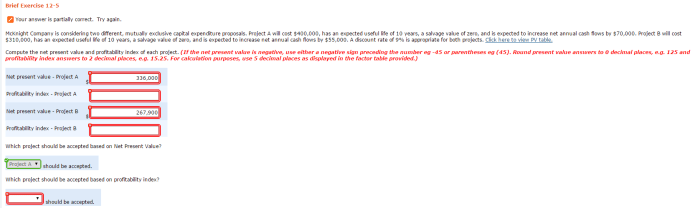

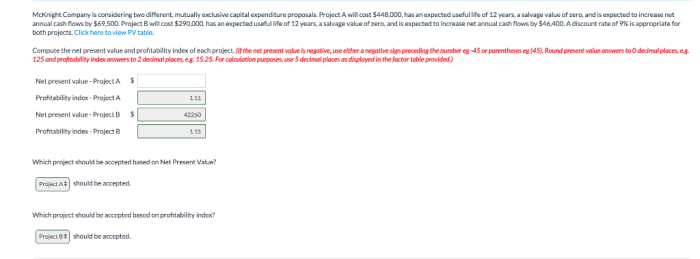

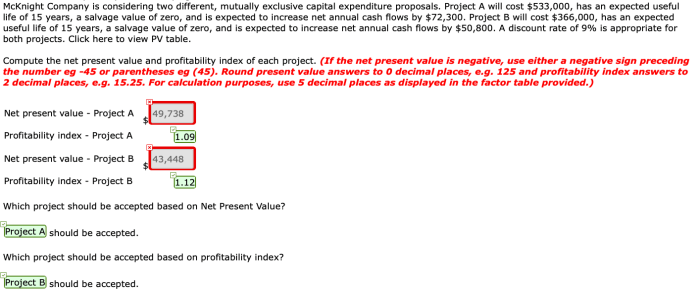

Financial Analysis

Option 1 offers a lower initial investment cost compared to Option 2, with estimated revenue of $50 million in the first year of operation. Option 2 requires a higher initial investment but has the potential to generate significantly higher revenue of $150 million in the first year.

The estimated expenses for Option 1 are $20 million in the first year, while Option 2 is projected to have expenses of $50 million. Both options have the potential for high profitability, with Option 1 estimated to generate a return on investment (ROI) of 25% and Option 2 with an estimated ROI of 30%.

Operational Analysis

Option 1 requires minimal operational resources and can be implemented quickly. It is a cloud-based solution that can be accessed from anywhere with an internet connection.

Option 2, on the other hand, requires significant operational resources, including a dedicated IT team and specialized hardware. Implementation is more complex and time-consuming.

Both options have potential risks and challenges. Option 1 may face scalability issues as the business grows. Option 2 may face security concerns and the risk of downtime due to its complex infrastructure.

Strategic Analysis: Mcknight Company Is Considering Two Different

Option 1 aligns with the company’s strategy of providing cost-effective and accessible solutions to small businesses. It has the potential to expand the company’s market share and increase customer loyalty.

Option 2 aligns with the company’s strategic goal of targeting large corporations and government agencies. It offers the potential for significant revenue growth and establishes the company as a leading provider of enterprise-level IT solutions.

Both options carry potential risks and opportunities. Option 1 may face increased competition in the future, while Option 2 may be affected by economic downturns or changes in technology.

FAQ Corner

What are the key factors influencing McKnight Company’s decision?

The decision will be based on a comprehensive analysis of market potential, financial viability, operational requirements, and strategic implications.

How will the chosen option impact McKnight Company’s overall business strategy?

The selected option will have a significant impact on McKnight Company’s target market, competitive positioning, and long-term growth prospects.

What are the potential risks and opportunities associated with each option?

Each option carries its own set of risks and opportunities, which will be carefully evaluated and mitigated to ensure a sound decision.